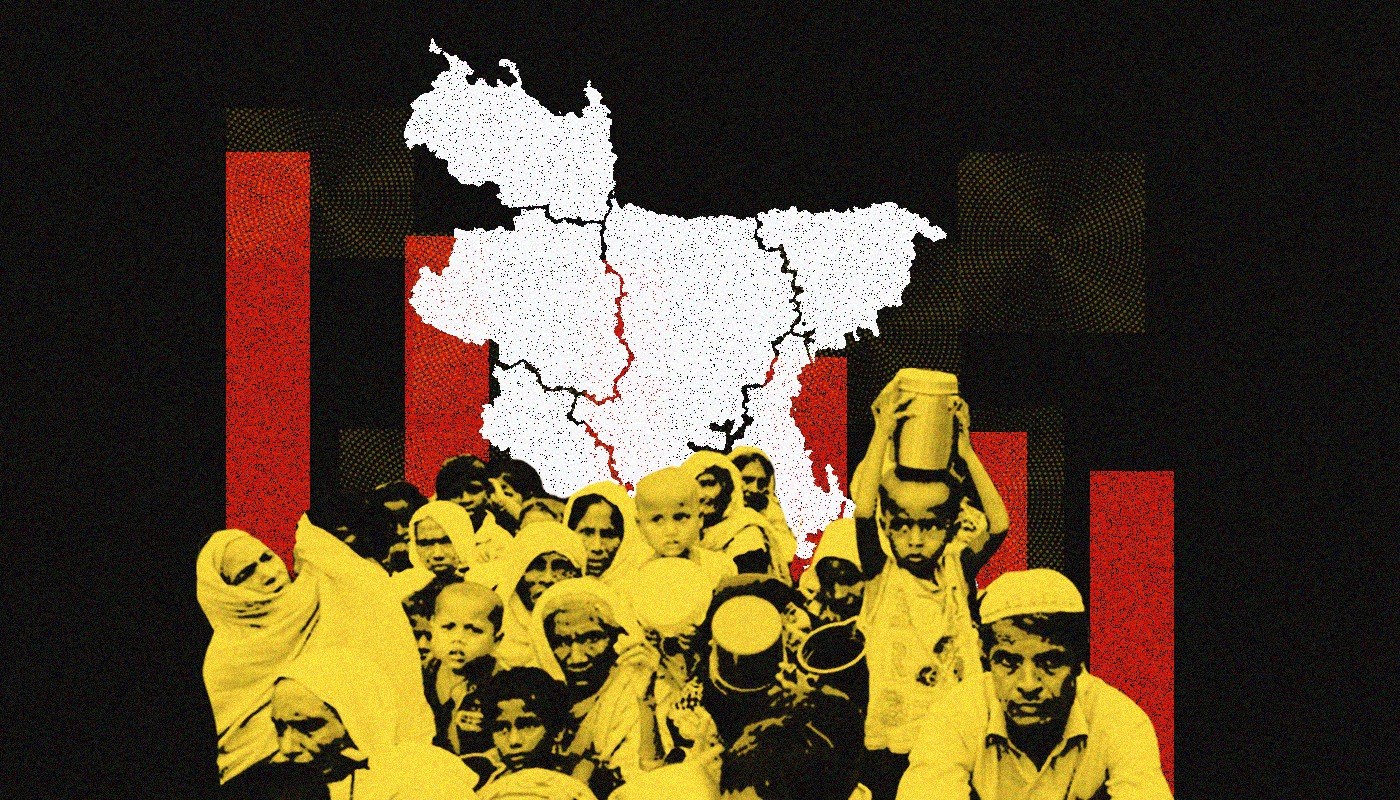

Fixing Bangladesh's economic woes

Fahmida Khatun

The beginning of 2025 fiscal year, starting from July 1, 2024, marked an unprecedented moment in Bangladesh’s history. What started as a demand for quota reform transformed into a powerful mass movement against discrimination, catalysing significant political change. The student-led mass uprising was a vivid reflection of the widespread discontent with a political system that had deteriorated over time. The fascist regime brewed on the broken political system that silenced public dissent and monopolised economic benefits, leaving a large section of Bangladeshis on the fringes.

It has been two months since the new interim government took responsibility for steering the country forward. It is too soon to expect any significant economic changes, particularly as the previous government, led by Sheikh Hasina, left behind a fragile economy marked by high inflation, declining foreign exchange reserves, sluggish private investment, a growing debt burden, poor revenue collection, inefficiencies in development project implementation, and weak governance in the financial sector. The economy now faces major challenges, including reducing poverty and controlling rising inequality, regaining growth momentum, and generating employment.

Therefore, repairing the fractures within the economy will require persistent and arduous efforts over an extended period. However, the right strategies and sustained efforts can improve the economy. While actions are needed in all areas of the economy, here are the top seven short- and medium-term issues that require the government’s immediate attention.

Curbing inflation

The interim government’s immediate economic action should be to stabilise and reduce the inflation rate, which will provide respite to low- and middle-income families and support economic growth. The point-to-point inflation rate increased to 10.49 percent in August 2024 compared to 6.15 percent in FY22. The food inflation was even higher at 11.36 percent in August 2024 compared to 6.05 percent in FY22. The repeated increase of electricity prices also pushed the non-food inflation rate to 9.74 percent in July from 6.31 percent in FY22. As wages did not increase, inflationary pressure increased the cost of living and eroded the purchasing power of low-income households.

The interim government has recognised the issue and initiated some measures. For example, the Bangladesh Bank (BB) has further attempted a contractionary monetary policy by increasing the policy rates from 8.5 percent to 9 percent from August 25, which is expected to reduce the money supply in the market. However, the contractionary policy cannot be successful without a complementary fiscal policy. The previous BB governor utterly failed to control inflation because he was reluctant to follow a tight monetary policy for a long time and could not stop printing money to underwrite expenditures. The government followed an expansionary fiscal policy as it neither reduced the size of the annual development programme (ADP) nor reduced operational costs and wastage during difficult times. The budget deficit for the FY25 was kept at 4.6 percent despite high inflation. The interim government has to revisit the national budget for FY25, as the targets and assumptions are far from reality.

Fixing external sector

The external sector has to be strengthened to restore macroeconomic stability. One of the major sources of macroeconomic challenges is the weakened external sector in recent periods. The forex reserve has been declining steadily and stood at 19.38 billion as of 18 September 2024. Under the previous government, BB undertook some measures to enhance the balance of payments and stop the decline in foreign exchange reserves. In FY23, it restricted imports of luxury consumer items to improve the balance of payment and reduce the current account deficit. This improved the trade and current account balances in FY24. However, this has restricted the imports of capital machinery and intermediate goods essential for production. If this trend continues, lower imports will have cascading negative effects on GDP through low investment, employment, and production.

With the objective of increasing liquidity in the interbank foreign exchange market and the volume of foreign exchange, BB has decided to increase the existing band for interbank foreign exchange transactions from 1 percent to 2.5 percent. BB has been following the crawling peg system to fix the foreign exchange rate, and the mid-value of the crawling peg was set at Tk 117, with the flexibility to increase up to Tk 118. Due to the bank’s new decision on August 18, the exchange rate of a dollar can increase up to Tk 120. It is expected that this measure will also help attract remittance through the banking channel. Though the number of migrant workers increased, remittance did not, despite a 2.5 percent incentive provided to remitters through the banking channel. This is partly due to a lack of sound exchange rate management. The policymakers also need to work towards tackling the hundi market, which runs through an international network.

Enhancing tax collection

Bangladesh’s tax collection should be enhanced through an efficient and corruption-free tax administration. The country’s tax-GDP ratio is very low compared to that of its peers. Though the target for tax-GDP ratio for FY2024 was set at 9 percent, the available data for FY24, up to April 2024, shows that the ratio for the first 10 months was 5.68 percent. In FY23, the ratio was 7.30 percent. As part of its $4.7 billion loan to Bangladesh, the International Monetary Fund (IMF) has suggested that the National Board of Revenue (NBR) increase its tax revenue by 0.5 percent every year. This requires improved tax policies and tangible administrative measures.

The interim government has changed NBR’s chairperson, who has announced that stern measures will be taken against tax evaders. The provision of black money whitening at a 15 percent tax has been partially blocked. The NBR has instructed its field officers of customs and VAT wings to formulate a time-bound automation plan by October 15, 2024. Reforms should be made in the NBR to strengthen anti-corruption measures within the tax administration, reduce leakages, and ensure that taxes collected are fully accounted for. Policy reforms are required to make the tax system more progressive, where higher-income earners pay a larger share of taxes. This will not only increase revenue but also address income inequality. The authorities have to ensure transparency in tax collection and expenditure to build trust among taxpayers. There should be independent bodies to monitor tax collection and public spending. E-governance initiatives should be in place to facilitate tax payments and management. Digital platforms can reduce administrative costs, make compliance easier, and increase overall efficiency. Simplification of the tax filing process can encourage voluntary compliance. There should be clear guidelines, user-friendly www.th platforms, and assistance services to make tax payments less burdensome for taxpayers.

Improving ADP’s performance

The performance of the Annual Development Programme (ADP) should be improved. While revenue collection is limited, government spending is also limited. ADP implementation remains unutilised.

The expenditure on the ADP as a percentage of GDP has been declining due to lower implementation of the ADP, which was 81 percent in FY24, a decrease from 85 percent in FY23 and 93 percent in FY22. Improving the implementation is crucial for ensuring that development projects are completed efficiently, within budget, and with the intended impact. Thorough feasibility studies that assess technical, financial, environmental, and social aspects should support all projects included in the ADP. This will help avoid delays and cost overruns. Additionally, prioritisation of projects based on national importance and alignment with strategic goals is vital. This will ensure that poorly conceived or low-impact projects are not included in the ADP.

The planning adviser has directed officials of the Bangladesh Planning Commission to categorise projects based on their economic contribution so that less important and politically-motivated projects can be identified. Projects undertaken on political considerations, which are not cost-effective, should be discontinued, and resources could be allocated for more productive purposes based on merit and strategic importance in the economy.

Rescuing banking sector

The banking sector has to be rescued from the corrupt business conglomerates that have syphoned out money from the banking system using political connections. The sector is grappling with high non-performing loans (NPL), which have increased to Tk 211,391 crore at the end of June 2024 from Tk 22,480 crore in 2008. Currently, the share of NPL is 12.56 percent of the total disbursed loans in the banking system, the highest in the past 16 years. The share of default loans at the state-owned banks was as high as 32.77 percent of their disbursed loans. The actual NPL figure would be significantly higher if distressed assets, loans in special mention accounts, loans under court injunctions, and rescheduled loans were considered.

The new BB governor has taken several measures to restore discipline in the sector. One was to dissolve boards of the troubled banks, which include Islami Bank Bangladesh, Social Islami Bank, Global Islami Bank, Union Bank, National Bank, First Security Islami Bank, Bangladesh Commerce Bank, Al-Arafah Islami Bank, United Commercial Bank, Exim Bank, and IFIC Bank. A task force has been formed to undertake reforms in the banking sector.

The Bangladesh Bank should also publish the report of the Criminal Investigation Department (CID), which has been probing the case of a heist in the central bank in 2016 when Tk 679.6 crore was lost from the treasury account of Bangladesh Bank with New York’s US Federal Reserve Bank by international cyber hackers.

Bolstering investments

Domestic and foreign investment should be enhanced to drive sustainable economic growth. Private investment has remained stagnant at around 23 percent of GDP for about a decade, while foreign direct investment (FDI) is less than one percent of GDP. Boosting private investment and FDI in Bangladesh requires a comprehensive approach that addresses the challenges faced by both domestic and international investors and leverages the country’s inherent economic strengths. The Bangladesh Investment Development Authority (BIDA) failed to attract investment due to various regulatory complications and corruption.

A multifaceted strategy is essential for fostering a more conducive environment for investment. Political and economic stability is a crucial factor that influences investment decisions. In the past, though one party ruled for about 15 years, economic stability gradually cracked due to corruption, bureaucratic red tape, inefficiency, and political interference in economic policymaking. Following the fall of the previous government and the formation of the interim government, potential investors are observing the current political and economic situation. The confidence of the investors must be regained by creating an enabling environment. There is an investor-friendly policy on paper, but the lack of an investor-friendly environment discourages prospective investors. Reliable infrastructure and a stable and adequate supply of electricity and other energy resources are crucial. Consistent monetary and fiscal policies are needed to avoid inflationary pressures and maintain stable exchange rates, both of which are important for investor confidence. Investors also require skilled human resources and technological adoption by the country.

Ensuring energy security

A comprehensive approach is required to ensure energy security and economic growth. To address the sector’s challenges, it is crucial to diversify energy sources, enhance energy efficiency, strengthen the regulatory framework, and improve governance. Expanding renewable energy by increasing investments in solar, wind, and hydroelectric power can reduce reliance on fossil fuels. Strengthening the regulatory framework is crucial for improving the sector’s governance. The Bangladesh Energy Regulatory Commission (BERC) must be strengthened to ensure its independence and capacity to enforce regulations. This includes regular updates to energy tariffs that reflect true costs and promote competition. A transparent and fair tariff-setting process that mirrors the actual cost of energy production and distribution while protecting vulnerable populations through targeted subsidies is necessary.

A few measures have already been taken by the interim government. A gazette to abolish Section 34(a) of “Bangladesh Energy Regulatory Commission (Amendment) Ordinance 2024” was issued. This implies that the government will no longer be able to determine the price of electricity and gas without a public hearing. The BERC will assume responsibility for setting jet fuel prices, a role previously managed by the Bangladesh Petroleum Corporation (BPC). The government reduced octane and petrol prices by Tk 6 per litre and diesel prices by Tk 1.25 per litre, effective from September 2024. The interim government has also postponed all negotiations, selections, and purchasing processes under the Quick Enhancement of Electricity and Energy Supply (Special Provision) Act 2010.

Improving governance and reducing corruption are key to the energy sector’s efficiency. The power sector has incurred large financial losses, exerted fiscal pressure on the government, and contributed to the macroeconomic challenges. The previous government adopted a non-transparent procurement and bidding process to allocate power plants to favoured conglomerates. Those should be reviewed and renegotiated on fair terms. Publication of reports on the status of energy sector reforms, financial health, and environmental impacts regularly can help maintain public accountability and build public trust and support for reforms.

Finally, the overarching message for the interim government is that it must work on structural issues, such as improving the efficiency of regulatory bodies by establishing good economic governance at public institutions. The previous regime’s oligarchs captured these institutions to extract public resources. However, the youth and people of Bangladesh sacrificed their lives for an inclusive and just society. People have entrusted the interim government to change the broken political and economic system. Work has been initiated in a few areas, as mentioned above, while a lot more needs to be done within a finite time.

Dr. Fahmida Khatun is the executive director at the Centre for Policy Dialogue and non-resident senior fellow of the Atlantic Council.

Views expressed in this article are the author’s own.

Back to Homepage